The Future of Card-Linked Shopping Offers is huge; CLO programs are one of the fastest-growing advertising mediums for brands and retailers due to their ability to solve challenges with marketing attribution and minimize upfront investment for marketers to achieve better ROAS with their performance campaigns.

Let’s review what are card-linked offers, the benefits to leverage this partnership model or to take advantage of additional savings, and the best platforms, companies, and industries already thriving with that model.

New to Affiliate Marketing?

Check out our Ultime Guide on How to Start Affiliate Marketing

What are Card-Linked Offers?

Card-linked offers (CLOs) are promotional deals or discounts that are linked to a payment card, such as a credit or debit card. These offers are typically provided by merchants or brands in partnership with financial institutions or payment processors.

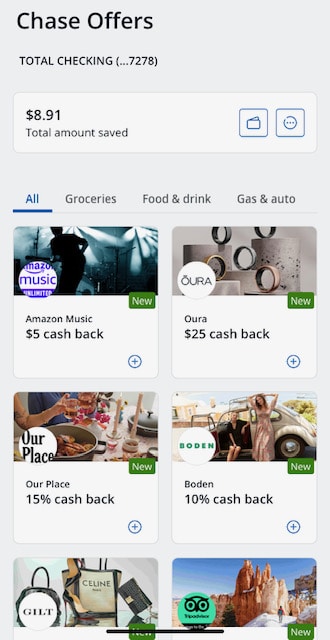

Chase offers example

The concept behind card-linked offers is to provide consumers with personalized discounts based on their spending habits and preferences. When a consumer makes a qualifying purchase using their linked card, the discount or reward is automatically applied to their transaction without the need for coupons, promo codes, or additional steps at the point of sale.

Like most affiliate partnerships, CLO providers typically work on a Cost-per-Revenue or Cost-per-Action model and fit seamlessly into existing affiliate programs.

To take advantage of card-linked offers, consumers usually need to opt into the program through their bank or credit card issuer. Once enrolled, the offers are tailored based on factors like the consumer’s past purchases, location, and demographics.

The discounts can range from a percentage off the total purchase to cashback rewards or points accumulation towards future purchases.

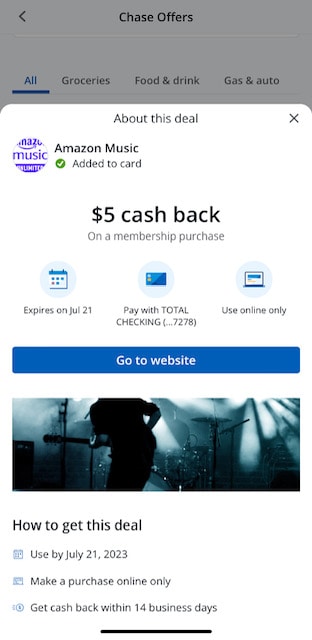

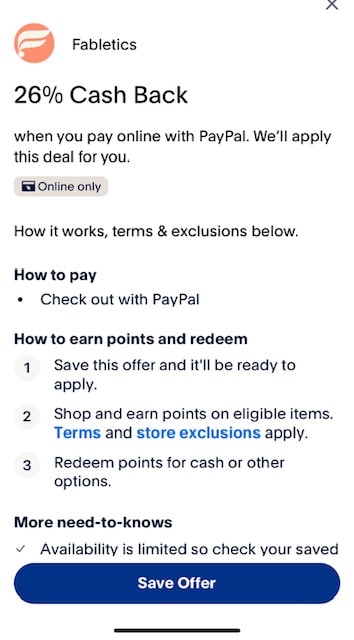

PayPal Rewards Example

Card-linked offers may have specific terms and conditions, such as a minimum purchase amount or restrictions on eligible products or locations. Consumers should review the details of each offer to ensure they meet the requirements and understand the benefits they will receive.

In the next section, we listed all the benefits of using card-linked offers whether you are looking to make more daily savings, prepare a trip if you are on a budget, or find new partnerships to leverage to optimize your affiliate program and boost your ROI,

Benefits of Card-Linked Offers

For Consumers

- A frictionless and hassle-free path-to-purchase experience.

- Personalized Discounts: CLOs provide consumers with personalized discounts and offers based on their spending habits, preferences, and demographics. CLOs are tailored to the consumer’s interests and past purchases, ensuring that the offers received are relevant and appealing.

- Seamless Redemption: Consumers can effortlessly redeem CLOs without the need for physical coupons, promo codes, or additional steps at the point of sale. The discounts are automatically applied when making a qualifying purchase using a linked payment card.

- Convenience: CLOs eliminate the need to search for and clip coupons or remember to bring them to the store. The discounts are conveniently linked to the consumer’s payment card, making it easy to take advantage of the offers during regular shopping.

- Savings on Everyday Purchases: Consumers can save money on everyday purchases, such as groceries, gas, dining out, clothing, or entertainment, by utilizing CLOs linked to their payment cards.

- No Loyalty Cards or Memberships Required: Unlike traditional loyalty programs that often require separate cards or memberships, CLOs are accessible through the consumer’s existing payment card, simplifying the process and reducing clutter.

- Transparency: Consumers can easily track and monitor their savings and benefits through transaction history or dedicated portals provided by the financial institution or card processor.

- Potential for Additional Rewards: By using cash-back portals to do their online shopping, shoppers potentially stack multiple offers from the same site. By finding a deal at their favorite retailer on a site like Rakuten and then paying with a card including a card-linked offer, they can multiply savings.

For Merchants and Advertisers

- Increased Customer Traffic: CLOs can attract new customers to the merchant’s establishment by offering enticing discounts and rewards. Consumers are more likely to choose a merchant that provides personalized offers aligned with their preferences directly tied to their everyday credit cards.

- Improved Customer Engagement: CLOs encourage repeat visits and foster customer loyalty. By providing targeted discounts, merchants can incentivize customers to return and make additional purchases.

- Data-Driven Insights: CLOs provide valuable data on consumer spending patterns, preferences, and demographics. Merchants can leverage this information to better understand their customer base, tailor their marketing strategies, and optimize their product offerings. Lean more into first-party data around transaction and purchase history and tap into better precision targeting that doesn’t rely on third-party cookies.

- Enhanced Marketing Opportunities: Merchants can leverage CLOs as a marketing tool to promote their products or services. The partnership with financial institutions or card processors allows for increased visibility among their customer base. Achieve an omnichannel strategy but use your affiliate partners’ digital marketing channels to drive traffic in-store and online.

- Cost-Effective Promotions: CLOs eliminate the need for traditional coupon distribution and redemption processes, which can be costly and time-consuming for merchants. With CLOs, discounts are automatically applied at the point of sale, reducing administrative overheads.

- Increased Transactions, Sales, and Revenue: By offering discounts and rewards through CLOs, merchants can drive sales, increase in revenue, and higher ROI on your current performance marketing mix. This is an opportunity to increase your transaction volume by up to 60% by adding CLOs to your affiliate strategy.

- Targeted Marketing: CLOs enable merchants to deliver targeted marketing campaigns based on consumer data. 75% of Gen Zers are likely to revisit businesses that offer cash back using CLOs. By tailoring offers to specific customer segments, merchants can maximize the effectiveness of their promotions and boost sales.

- Competitive Advantage: Implementing CLOs gives merchants a competitive edge by providing a unique and convenient shopping experience. It differentiates them from competitors and can attract customers seeking personalized discounts and seamless redemption.

- Stronger Partnerships: Partnering with financial institutions or card processors for CLOs can strengthen relationships with these entities. This collaboration opens doors to potential joint marketing initiatives and cross-promotions.

- Customer Insights and Feedback: CLOs can facilitate direct communication with customers, allowing merchants to gather feedback and insights on their offerings. This feedback loop helps in improving products, services, and overall customer satisfaction.

Example of Geographic targeting

Let’s say you’re a restaurant chain with locations in multiple cities. To target specific geographies, you can offer location-based card-linked offers.

For instance, you can collaborate with a card-linked offer platform to provide exclusive discounts or rewards to customers who use their linked cards at your restaurants in a particular city or region.

This allows you to attract local customers, increase foot traffic to those specific locations, and create a sense of personalized engagement for customers in those areas.

Example of Demographic targeting

Suppose you’re a fashion retailer aiming to target a specific demographic, such as young adults. By analyzing customer data and preferences, you may discover that this demographic is more inclined to shop online.

In this case, you can partner with a card-linked offer platform to offer personalized discounts or cashback rewards when customers make online purchases using their linked cards.

Additionally, you can leverage social media platforms and digital advertising to reach this demographic with targeted ads promoting your card-linked offers. This approach allows you to effectively engage with your target demographic and incentivize them to make purchases while aligning with their preferred shopping behaviors.

Companies can use geofencing and beacons to detect a customer’s smartphone. Those customers can then be targeted with relevant location-based deals and cashback offers for nearby retailers, restaurants, and services. The closer the rewards are to the consumer’s real-time location and preferences, the higher the chances of redemption.

For Partners & Financial Institutions

Card-linked offers a valuable tool for financial institutions, providing opportunities for increased card usage, customer loyalty, data monetization, and strategic partnerships:

- An opportunity to attract new segments of consumers.

- Increased Card Usage: CLOs incentivize cardholders to use their payment cards more frequently, leading to increased transaction volume and interchange fees for financial institutions. CLOs unlock up to 60% increase in cardholders engaging and redeeming offers.

- Enhanced Customer Loyalty: By offering CLOs as a value-added service, financial institutions can strengthen customer loyalty and retention. Cardholders are more likely to stay with a bank or credit card issuer that provides personalized discounts and rewards.

- Differentiation in the Market: Implementing CLOs sets financial institutions apart from competitors and positions them as innovative and customer-centric. This differentiation can attract new customers and drive customer acquisition.

- Data Monetization: CLOs provide financial institutions with valuable transaction data, allowing them to gain insights into consumer spending habits, preferences, and trends. This data can be leveraged for targeted marketing, product development, and data monetization opportunities.

- Strategic Partnerships: CLOs enable financial institutions to form strategic partnerships with merchants and card processors, fostering collaboration and mutually beneficial relationships.

- Increased Cardholder Engagement: CLOs encourage cardholders to actively engage with their financial institution’s mobile app or online banking portal, leading to increased usage and interaction with other banking services.

- Improved Customer Experience: CLOs enhance the overall customer experience by providing personalized discounts and seamless redemption. This positive experience reflects well on the financial institution and can lead to increased customer satisfaction.

- Additional Revenue Streams: Financial institutions can explore additional revenue streams through partnerships and co-marketing arrangements with merchants. This can include revenue sharing, advertising fees, or transaction-based incentives.

- Enhanced Brand Image: Offering CLOs demonstrates that the financial institution is forward-thinking, customer-focused, and technologically advanced. This strengthens the brand image and can attract tech-savvy and digitally engaged customers.

- Data-Driven Decision Making: The data obtained from CLOs allows financial institutions to make data-driven decisions and develop targeted marketing strategies. It provides insights into customer behavior and preferences, enabling more effective customer segmentation and personalized marketing efforts.

Best Industries for Card-Linked Offers

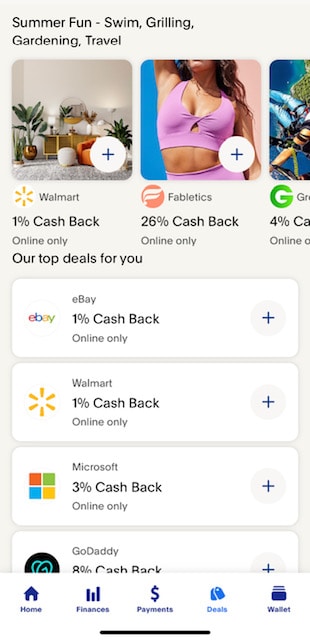

We listed some examples of top cash-back offers by industries and verticals. This list is not exhaustive and many new merchants and brands start participating in these programs;

- Groceries – 5 to 15% cash back – GoPuff , Kroger, Amazon Fresh

- Food and Beverage – 10 to 50% cash back – Paneira Bread, Shake Shack

- Shopping – 5 to 20% cash back – Aldo, Dell, Norton, Zulily, Allbirds, Brooks, Paul Smith, Amazon Music, Oura

- Travel – 10 to 25% cash back – Courtyard by Marriott, Sheraton Hotels, Westin Hotels and Resorts, ZipCar, Carnival Cruise

- Home & Pet – 10 to 15% or $15-$25 cash back – Chewy, Cozy Earth, Famer’s Dog, Made in Cookware

- Entertainment -10 to 20% or $5-$20 cash back – Kindle, Paramount +, TopGolf, ESPN+

- Health & Beauty – an average of 10% cash back – Quip, The Art of Shaving, Glossier, Ulta Beauty

- Gas & Auto -10 to 20% cash back – Chevron, Safelite Autoglass, Tire Kingdom

Card-Linked Offers FAQ

How do I find card-link offers?

Card-link offers are typically available through various sources. You can find them through your bank or credit card issuer’s mobile app or website, as well as through third-party coupon or deal platforms that specialize in aggregating such offers.

Are card-link offers free to use?

Yes, card-link offers are generally free to use. There is usually no additional cost or fee associated with accessing or activating these offers. However, keep in mind that you still need to make a qualifying purchase to receive the benefits of the offer.

Do I need to sign up for card-link offers?

In most cases, you need to sign up or opt in for card-link offers. This can be done through your bank or credit card issuer’s website or mobile app. You may need to provide your consent to link your card and receive promotional offers.

How long does the card-link offer last?

The duration of card-link offers can vary. Some offers may be valid for a limited time, such as a few days or weeks, while others may have a longer validity period. It’s recommended to check the offer details for the specific expiration date or duration.

What happens if I return an item I purchased using a card-link offer?

If you return an item that was purchased using a card-link offer, the associated benefits may be reversed. Depending on the offer and the merchant’s return policy, you may lose the discount or cashback received. It’s advisable to review the terms and conditions of each offer and the return policy of the merchant to understand the potential impact on the offer benefits.

Is Your Affiliate Program Fully Optimized For Growth?

Take Our 2-Minute Quiz to Find Your Score!

Whether you are getting started with affiliate marketing or are responsible for scaling a mature program, there is always a new opportunity to unlock profitable growth.

Wrapping-Up

Overall, card-linked offers leverage the transaction data from payment cards to provide personalized discounts and rewards, enhancing the shopping experience for consumers while driving customer engagement and sales for merchants.

Whether you are a publisher, creator, consumer, or work with financial institutions, CLOs is definitely a “win-win-win” affiliate partnership model to develop in 2026.

Are you a merchant or a business owner looking to find CLO partnerships and scale your revenue? Contact us for more details about your affiliate and CLO strategy.

For everyone else, happy shopping and happy savings!

Your Success Starts with The Good Strategy!